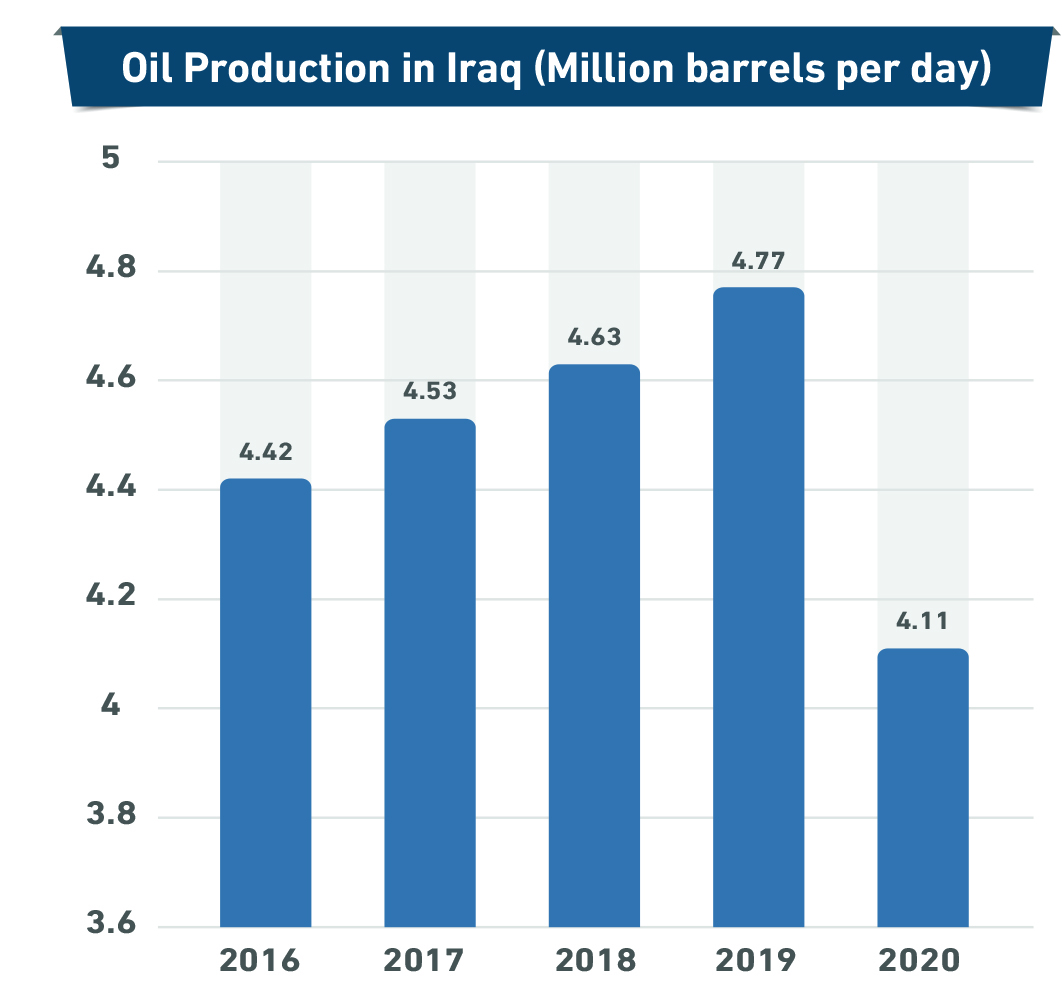

Numerous foreign oil companies have recently announced plans to sell their shares in several major oil fields in Iraq, as part of measures that may negatively impact Iraqi oil production. There are multiple explanations for this step, including unstable security and political conditions as well as Iraq's failure to pay foreign companies their dues for operating the fields, in addition to the growing Chinese influence in the oil sector.

An exit plan

Over the past two decades, foreign oil companies in Iraq managed to coexist with the pressing political and security conditions in Iraq, and to continue production from the country's main oil fields without any significant implications. However, this situation did not last long amid the worsening political and security deterioration in Iraq over the past period. This prompted several foreign companies such as British Petroleum, ExxonMobil and Lukoil to consider leaving Iraq. These are among the multinational oil companies engaged in the extraction and production of oil in various parts of Iraq, particularly in the South.

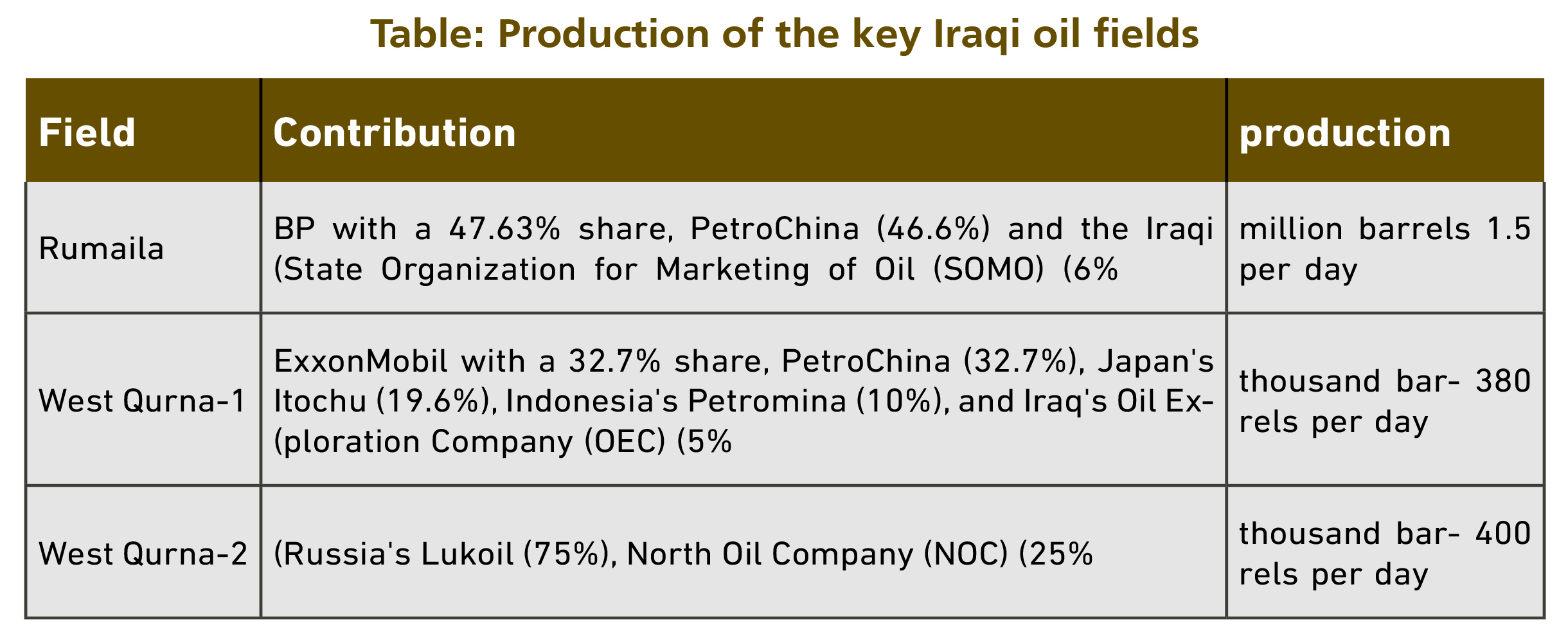

On July 4, Oil Minister Ihsan Abdul-Jabbar Ismail stated that these three previous companies announced their desire to exit the Iraqi market, while each of them owns controlling shares in Iraq's major oil fields. They are also considered the main operators of these fields, while the rest of the field ownership is split between Chinese companies and companies owned by the Iraqi government. This is not the first time that foreign oil companies leave Iraq. Shell had previously withdrawn its investments from Iraq and sold its share in the Majnoon oil field in Basra in 2018.

None of the three companies provided detailed reasons for their decision, except for BP, which indicated the intention to establish a separate company owned in partnership with the China National Petroleum Corporation, in order to operate the Rumaila oil field. The new company would have an independent financial position from the parent company. This comes as part of BP's desire to separate the fossil fuel activity from the parent company.

ExxonMobil informed the Iraqi government of its insistence on selling its share in the West Qurna-1 field, for no more than $400 M, a price described by the Iraqi Oil Minister as very cheap, which reflects the company's desire for a quick exit from Iraq. Lukoil sent a notice to the Iraqi Oil Ministry expressing its desire to sell its share in West Qurna-2 to Chinese investors. However, it reversed this step, according to a statement by the Iraqi Oil Minister on August 1.

Possible clarifications

Multiple security, political and economic factors combine to push foreign oil companies out of the Iraqi oil market, most notably the following:

1-Iraq’s breach of its financial obligations to the companies: Iraq experienced a serious financial crisis with the collapse of oil prices in 2016, which forced it to postpone payments of dues to Western companies in return for their operating oil fields according to the contracts signed with the Iraqi government.

Not only that, but foreign companies consider that the fees they receive from the Iraqi Oil Ministry are unrewarding from an investment point of view. The Iraqi Oil Minister had previously stated that ExxonMobil's annual profits in Iraq did not exceed $100 M, which is quite a weak return.

2- A stressful security environment for companies: Foreign oil companies and their employees have become the target of recurring attacks by armed actors in Iraq, including terrorist groups such as ISIS and armed Shiite militias which are pervasive in Iraq.

Oil companies often have to pay royalties to armed clans or even some armed groups in return for their protection. US companies, led by ExxonMobil, had previously evacuated their employees after the repeated attacks on their headquarters over the past months. Additionally, the recent public protests have led to the suspension of production in some fields in Southern Iraq.

3- Growing Chinese influence in Iraq: Chinese companies hold shares in several key fields in Iraq. Numerous views indicate that Beijing has taken advantage of this situation to obtain monopolistic commercial deals, including drilling oil wells, developing oil refineries, in addition to engineering and construction contracts in the Iraqi oil sector, which came in detriment to the interests of other companies.

For example, the China Petroleum Engineering and Construction Corporation (CPECC) obtained an engineering contract worth $121 M to modernize facilities used to extract gas for oil production in the West Qurna-1 oil field in 2019, while ExxonMobil holds a major share there. The development of the Al-Faw refinery was recently granted to a group of Chinese companies at a cost of $7 billion, and the Chinese government will finance this project.

China's influence in the Iraqi oil sector has grown after Chinese companies replaced Western companies which withdrew from the Iraqi market over the past decade. At present, Chinese companies operate directly and indirectly in 15 oil fields in Southern Iraq. China also receives more than a quarter of Iraqi oil exports, which are around 3 million barrels per day.

Thus, reports suggest that China has an influence over Iraqi oil policy, which it exploits in favor of steering oil projects for the interests of its companies at the expense of European and US companies. Yousef Al-Kalabi, a member of the Iraqi Parliamentary Integrity Committee, claimed that the Chinese Ambassador in Baghdad is blatantly interfering with the work of the Ministry of Oil and with issues that are irrelevant to diplomacy or the protection of Chinese citizens.

4- Invisible costs: foreign enterprises in Iraq are usually subject to hidden costs in the form of commissions paid to corrupt officials. For example, foreign oil companies pay royalties to the militias dominating the handling of Iraqi ports in exchange for the release of oil equipment and machinery.

5- Review of the internal operations of foreign companies: there are other reasons relevant to the companies themselves, which led them to consider leaving Iraq. Many foreign oil companies are restructuring their operations, eliminating fossil fuel assets and investing in clean energy under pressure from shareholders, or even focusing on gas, such as the case of BP.

In that respect, Shell withdrew from Iraq as part of its plan to restructure its global business, after its acquisition of BG Group, which includes a program to dispose of assets worth $30 billion, and to focus on gas and petrochemical assets.

Possible Iraqi alternatives

Obviously, the Iraqi Ministry of Oil has announced its keenness to have the work of foreign oil companies continue in Iraq. This is quite justifiable due to these companies’ high technical competencies and advanced technological capabilities, in a way that advances the stability of oil production and facilitates Iraq’s access to various markets. This also helps preserve Iraq's political interests with major international powers. Mustafa Al-Kadhimi, the Iraqi Prime Minister, recently stated that he wants another US company to replace ExxonMobil in case it leaves Iraq.

Practically, Iraq needs more serious actions to preserve the investments of foreign oil companies in Iraq. The Iraqi government must review its contractual obligations with these companies, so that the latter’s participation in oil projects would be more profitable for them, in addition to Iraq distributing oil deals in a way that supports its relations with various parties.

Perhaps the foreign companies' announcement of withdrawal from Iraq is nothing but maneuvers to pressure the Iraqi government to improve its financial and security conditions in Iraq. Here, it is worth noting that foreign companies such as BP will not easily abandon the strategic assets they own in Iraq, particularly the Rumaila field, which contributes with more than a third of Iraqi production.

In case foreign companies insist on leaving Iraq, the Iraqi government has no choice but to manage these fields through state oil companies, or to allow Chinese companies to buy the departing company’s share. Chinese companies have shown high flexibility in dealing with the difficult situation in Iraq, and it seems that Beijing is ready to seize this opportunity.