In an era marked by the rise of the GIG economy and the proliferation of virtual reality, traditional regulated entities are gradually giving way to less regulated counterparts. There are countless examples of virtual networks, irregulated platforms, digital currencies, smart software, and e-commerce websites replacing traditional stock exchanges, sovereign currencies, and physical markets. The transformation is pervasive and multifaceted.

New Regionalism vs. Globalization

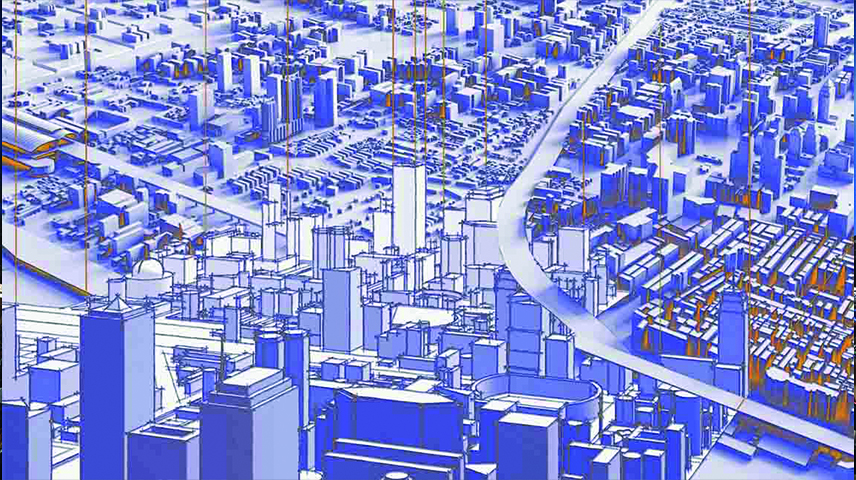

Whereas globalization is advantageous for a few developed markets over the rest of the globe, many nations have recognized this reality and begun constructing specialized, yet more efficient, regional replacements. While tailoring these alternatives, several progressive leaders considered a fast road to regional cooperation that incorporates geopolitical developments and global transformations. This fast track is commonly laid in the Middle East and North Africa (MENA) as part of various intergovernmental megaprojects.

Political regional coalitions were once the norm, but not anymore. Instead, multilateral megaprojects strategically placed around the area promote intergovernmental economic cooperation. One notable example is the "Ras El Hekma" project on Egypt's north coast. The UAE is expected to attract USD 150 billion in this project to convert the region into a trade, tourism, logistics, real estate, and manufacturing hub. The profits from this investment will be distributed among nations that play important roles in its development and funding.

Mega Projects Diplomacy

If a single project can drive a large economy—such as Egypt's, which has weathered economic crises since the COVID-19 outbreak—then an interconnected network of regional megaprojects can establish lasting economic integration. These projects should be labor, material, and mineral intensive, enabling near-sourcing for all involved parties. Critical Resource Management (CRM) can then be regionally coordinated. Egypt, the UAE, and Saudi Arabia can supply steel, aluminum, cement, and other building materials. Labor force recruitment can be optimized with skilled workers sourced from diverse markets. The UAE's logistics and port management expertise further enhances the project's viability.

Before the "Ras El Hekma" project, the EastMed Pipeline played a crucial role in strengthening political, military, and economic ties among MENA neighbors. Collaborations between Israel, Greece, and Cyprus in energy led to significant milestones. Maritime agreements facilitated gas exploration, and deals were struck to transport gas to Europe. The development of the Gaza Marine gas field resolved longstanding disputes. Despite disruptions due to the Gaza war, the East Mediterranean Gas Pipeline resumed operations in mid-November 2023. Egypt remains committed to regional investment, although uncertainties in LNG exports and ongoing conflicts pose challenges.

Prior to the Ras El Hekma project, The EastMed Pipeline project was utilized to foster political, military, and economic ties between some of MENA's neighbors. In 2016, the Israel-Greece-Cyprus collaboration in energy reached a milestone, supported by a high-level summit and US participation. Washington facilitated a maritime agreement between Israel and Lebanon, allowing gas exploration. The EU signed a deal with Egypt and Israel to transport gas to Europe. EMGF members agreed to develop Gaza Marine, resolving a longstanding dispute. Egypt's EGAS would lead to gas extraction.

The Gaza war has had minimal impact on the East Mediterranean Gas Pipeline, temporarily disrupting gas supply, but ultimately resumed in mid-November 2023. Egypt delayed plans to develop the Gaza Marine gas field but remains committed to regional investment. Uncertain prospects for LNG exports from Egypt may impact the EastMed gas industry's future as a major exporter. The ongoing war could also affect Suez Canal shipping costs and increase the price of Qatari LNG if it escalates.

So, that project proved to be more resilient than many other UN resolutions and political multilateral arrangements. Observers may say the same about the Egyptian-Turkish economic relationships that were hardly affected by political tensions on the back of the outstation of the Muslim Brotherhood from authority in Egypt in mid-2013. If arranged under self-sustainable regional mega projects, economic ties can obtain positive externalities to countries beyond their expectations.

Drivers of Geopolitical Shifts

Various factors, such as technology, demographics, politics, and climate change, drive geopolitical shifts. Disruptions occur due to the accumulation of these elements over time, frequently worsened by stability illusions. The globe is returning to a multipolar structure, challenging the exclusive dominance of the United States' economic strength. China's future as the world's largest economy is questionable owing to reasons such as dwindling population, shifting demand, and a reliance on state-owned enterprises. Geopolitical tensions may also have an influence on international commerce with China, so damaging global GDP. Improved internal markets might help the United States and the European Union maintain economic leadership. Other nations, such as India and ASEAN, might advance in the global economy. Europe may look for chances in Africa and find ways to cohabit with Russia and China.

Middle East Paradigm-Shifts

Paradigm shifts and diplomatic maneuvers in the Middle East have produced mixed effects, increasing competitiveness among several Mediterranean states. Normalization efforts between Arab states and Israel face challenges caused by the war in Gaza and the sluggish peace process. Fragility and war impede economic, social, and political progress in the Arab world, emphasizing the need for a regional approach to restoring peace and stability.

Scholars in economic geography and regional studies disagree on defining and explaining resilience in regional economies. Historical processes and experiences determine regional economies' resilience, influencing their ability to deal with shocks. Disruptions such as the COVID-19 crisis have highlighted the necessity of regional economic resilience.

A new perspective on transformational resilience looks beyond economic recovery to address societal and environmental issues. Policy should prioritize reorienting regional innovation systems toward sustainable results and encouraging challenge-oriented innovation. The current conflict in Gaza has regional and global implications, prompting caution regarding possible instability.

Regional Projects in the Womb of the Crises

A dual approach- economic reconstruction and institutional strengthening- is essential in conflict-prone areas like Iraq, Sudan, Yemen, and Libya. Arab nations can play a pivotal role in supporting the establishment of a robust Palestinian state. Addressing climate change and water scarcity also presents opportunities for further economic cooperation.

The scarcity of water and decreasing soil quality are expected to reduce agricultural productivity in the region by 21% by the end of the century. In 2022, 13% of Arabs were malnourished, with 24% living in conflict zones, and 15% of children under the age of five were stunted. The region's heavy reliance on imported goods will only grow, but efforts to attain self-sufficiency may fail. To meet existential issues, a regional food and water security plan is required, with a focus on boosting supply, enhancing land and water use efficiency, and increasing import access.

The IEA's ambitious vision for a net-zero world by 2050 underscores the urgency of transitioning to cleaner and greener energy sources. Achieving this goal requires substantial growth in renewable energy capacity, particularly from wind and solar photovoltaic (PV) technologies. According to the study, by 2050, renewable energy sources must contribute to around 90% of total electricity generation, with wind and solar photovoltaic power contributing 70%.

Leading Future Sustainable Projects

The Middle East has an advantage over the United States and Europe, where obtaining government permission to develop wind farms can take years, and local people frequently oppose projects. Projects in the Middle East seldom face these challenges, but nations worldwide are dealing with increased raw material costs and supply chain delays.

Wind farms need large areas of land and enough wind speeds. Small turbines can run on wind speeds of 4 meters per second, but bigger, utility-scale turbines need wind rates of 5.8 meters per second. Several nations in the Middle East and North Africa have places appropriate for wind projects, including Egypt's Gulf of Suez, the Atlantic coast, and certain eastern sections of Morocco, Saudi Arabia's northwestern desert, and southern Oman.

According to a March analysis by the Abu Dhabi-based International Renewable Energy Agency, wind and solar energy dominated worldwide renewable capacity growth in 2022, accounting for 90% of all net renewable additions and generating the biggest increase in renewable power capacity on record. The Middle East also had the largest rise in renewable energy on record, with 3.2 gigawatts of new capacity commissioned in 2022, the great majority of which was solar. Despite this progress, the Middle East has just 28.54 GW of installed renewable generating capacity in 2022, accounting for less than 1% of total world capacity, the lowest of any area; however, the Middle East's share is expected to rise somewhat in 2023. Egypt, which IRENA classifies as an African area, is predicted to have a wind capacity of 1.64 GW in 2022, more than the whole Middle East, thanks to projects mostly located in the Gulf of Suez, where wind speeds can approach 10 meters per second. Morocco is predicted to have 1.56 GW of installed wind capacity in 2022, slightly more than the current solar capacity.

Growth, Debts and Uncertainty

The MENA region faces lackluster growth, exacerbated by increased debt and heightened uncertainty due to conflicts. Despite the challenges, The World Bank's new Middle East and North Africa Economic Update forecasts a return to low growth rates similar to pre-pandemic levels, with GDP expected to rise to 2.7% in 2024. Oil-importing and exporting countries are projected to have less disparate growth rates compared to previous years. However, the conflict has severely impacted Gaza's economy, resulting in a significant drop in GDP.

The MENA region has witnessed a surge in debt levels. Between 2013 and 2019, the median debt-to-GDP ratio for economies increased by over 23 percentage points. The pandemic further strained finances, necessitating additional financing due to declining revenue and increased support spending. Notably, oil-importing countries bear a heavier debt burden, with their debt-to-GDP ratio 50% higher than the global average for emerging markets. Fiscal discipline and structural reforms are essential for sustainable growth.

Economies in the southern and eastern Mediterranean have coped relatively well with challenges. However, they face high inflation and sovereign stress. Debt sustainability concerns persist in Tunisia and Egypt. On a positive note, improvements in tourism and agricultural conditions contribute to growth. The region is expected to achieve a 3.7% growth rate in 2023 despite food and energy security risks and limited private sector expansion.

Aspirations for Equity and Cooperation

MENA countries should aim for sustained growth rates double the current average to bridge the gap with developed nations. Achieving equity requires concerted efforts and effective regional cooperation is crucial. The EU has recognized this and is actively pursuing enhanced forms of regional integration. Balancing spillovers across all parties through socio-economically feasible projects can foster success.