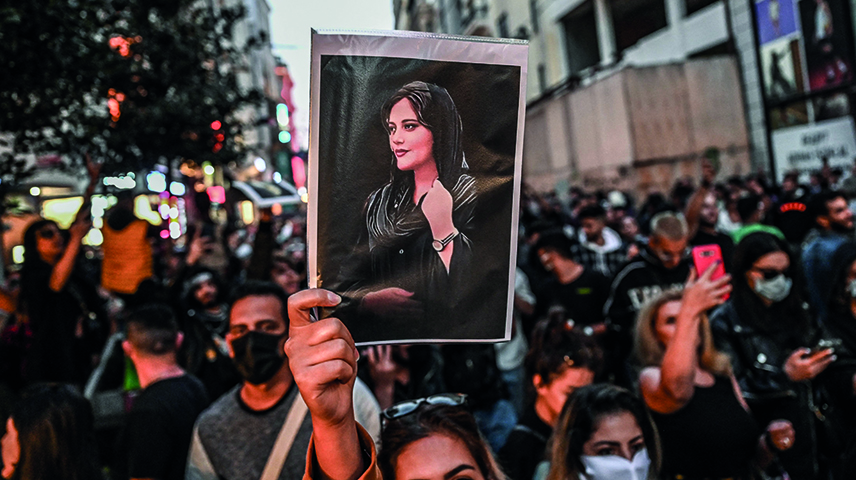

Widespread protests broke out across Iran after the death of Mahsa Amini in a hospital in Tehran in September 2022 while in the custody of the country's morality police. While the current protests differ from previous protests in that protestors demanded women's rights be respected. Later, the protests spread, and the protesters demanded regime change. Yet, the economy's deterioration is one of the main drivers of the spread of the angry protests.

As social unrest is likely to further exacerbate across Iran, the protests are likely to incur financial and trade losses, further complicating the economic situation.

Economic Crisis

Iran protests soon turned into a social movement led by the anti-regime middle class spurred by the regime's failure to efficiently manage the Iranian economy and deal with the economic challenges, which can be described as follows:

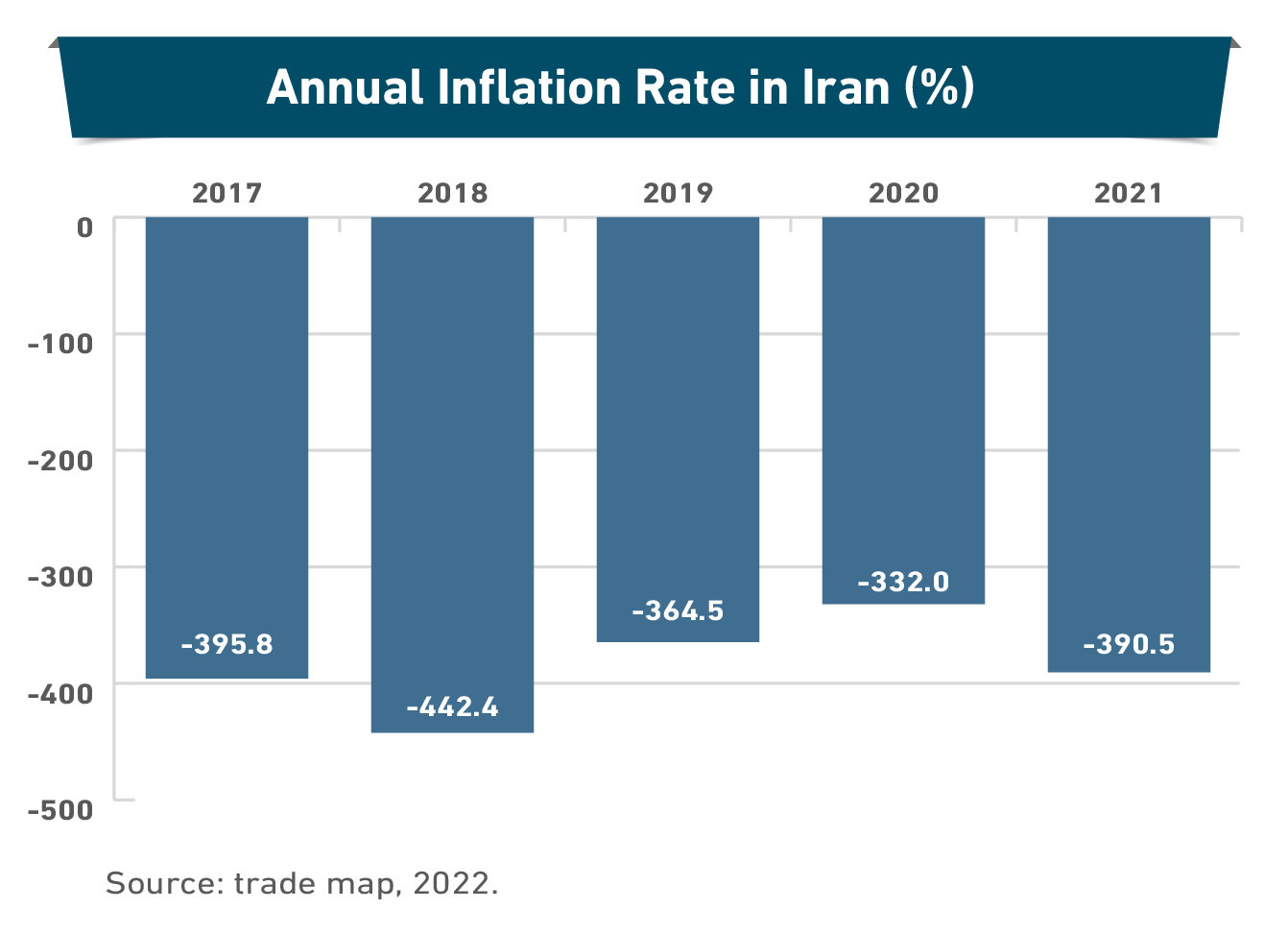

1. Worsening inflation:

Rising inflation is a persistent issue in the Iranian economy. Except for 2016 and 2017, when the lifting of the sanctions following the nuclear deal drove it down to below 10%, inflation kept rising over the past two decades, and in recent years it went up to as high as 40.1 % in 2021, according to the International Monetary Fund.

In recent months, inflation in Iran stood at 39% in May, according to the World Bank. Currently, a majority of estimates put it at about 50%, driven by rising consumer prices following the removal of subsidies. The situation ratcheted up pressure on low-income segments and further weakened the purchasing power of citizens.

2. Iran’s rial losing value:

The Iranian currency plummeted to record lows against the dollar over the past months. The fall was triggered by the failure of the nuclear talks between Iran and Western powers. The rial lost more than a quarter of its value to trade at 360000 to the dollar. It should be noted that the Iranian authorities’ attempts to back the rial have depleted the country’s foreign currency reserves.

3. Sluggish economy:

Despite its positive growth that stood at 4.7 in the fiscal year 2021/2022 (from March 21, 2021, to March 20, 2022, rising inflation and the weakening currency had a negative impact on the economy. A majority of international institutions expect a decline in the growth rate of the Iranian economy during this year.

4. Rising unemployment:

The Iranian economy is suffering from soaring unemployment. According to the World Bank, unemployment in Iran reached 11.5% of the total labor force in 2021. The rate stood at 19% among females and 9.9% among males. But on the other side, the government is working on creating jobs. In the first eight months of the current fiscal year, some 750000 new jobs were generated, and the government says there are between 300000 and 400000 jobs that were not filled, yet.

5. Worsening living conditions:

Iranian citizens are suffering from worsening living conditions after the government decided to remove subsidies for food imports by removing the subsidized or preferential exchange rate for the dollar. The move caused prices of essential goods, including grain, to soar, thus increasing the burden on Iranian households. Policies followed by the Iranian government to compensate the segments affected by soaring prices failed.

6. Rising poverty rates:

The poverty rate in Iran soared in recent years because of the deteriorating living conditions. Up to a third of Iran’s population live under the poverty line, while the latest figures from the World Bank show that the rate reached 27.6% in 2019.

Protests' Impact

The current protests will likely cause negative economic consequences, especially if they escalate further. The ions outstanding consequences are as follows:

1. Damage to property and infrastructure:

The damage is inevitable, especially if the protests escalate and the angry protestors set fire to public buildings and property.

2. Internet outage losses:

The Iranian security services often respond to protests by cutting internet access. One day of internet outage costs the Iranian economy more than US$38 million. Moreover, internet disruption incurred losses for thousands of small businesses relying on direct selling and marketing through social media.

3. Boycotting the IRGC businesses:

More Iranian consumers are boycotting big companies and retailers believed to be controlled by the Iranian Revolutionary Guard Corps and other entities of the ruling regime. The IRGC controls about a third of Iran's economy, and all airports and seaports, in addition to managing a large number of companies. Moreover, small and medium-sized businesses are impacted because of the weakening purchasing power of citizens and the ongoing protests.

4. Sluggish economic growth:

Because of the protests, the World Bank lowered its forecasts for Iran's economic growth and expects the country's real GDP to rise by 2.9% in 2022, compared to 3.7%, and by 2.2% in 2023. According to the latest World Bank report on the region's economies, this will be the lowest growth rate among oil-exporting countries in the Middle East and North Africa.

5. The weakening rial:

The Iranian rial is falling against the dollar amid economic pressures and ongoing protests. On November 5, 2022, the rial fell to a record low of 360000 to the dollar and is likely to hit new record lows in the coming weeks.

6. Impact on investments and oil exports:

If the protests continue and escalate in the oil-rich provinces, investment in the energy sector might be impacted, and oil production and exports might be disrupted. Income from oil exports was up 580% in the first four months of the Iranian year (March 21-July 21).

6. Brain drain:

Social unrest further hastened Iran's brain drain, where more young Iranians prefer to migrate and escape the worsening economic situation to look for better education and careers outside Iran. The International Monetary Fund estimates that because of losing the well-educated youth, Iran is running a capital loss of US$50 billion every year.

Overtaking Opportunities

Several factors will likely fuel Iran's social unrest in the coming months, namely:

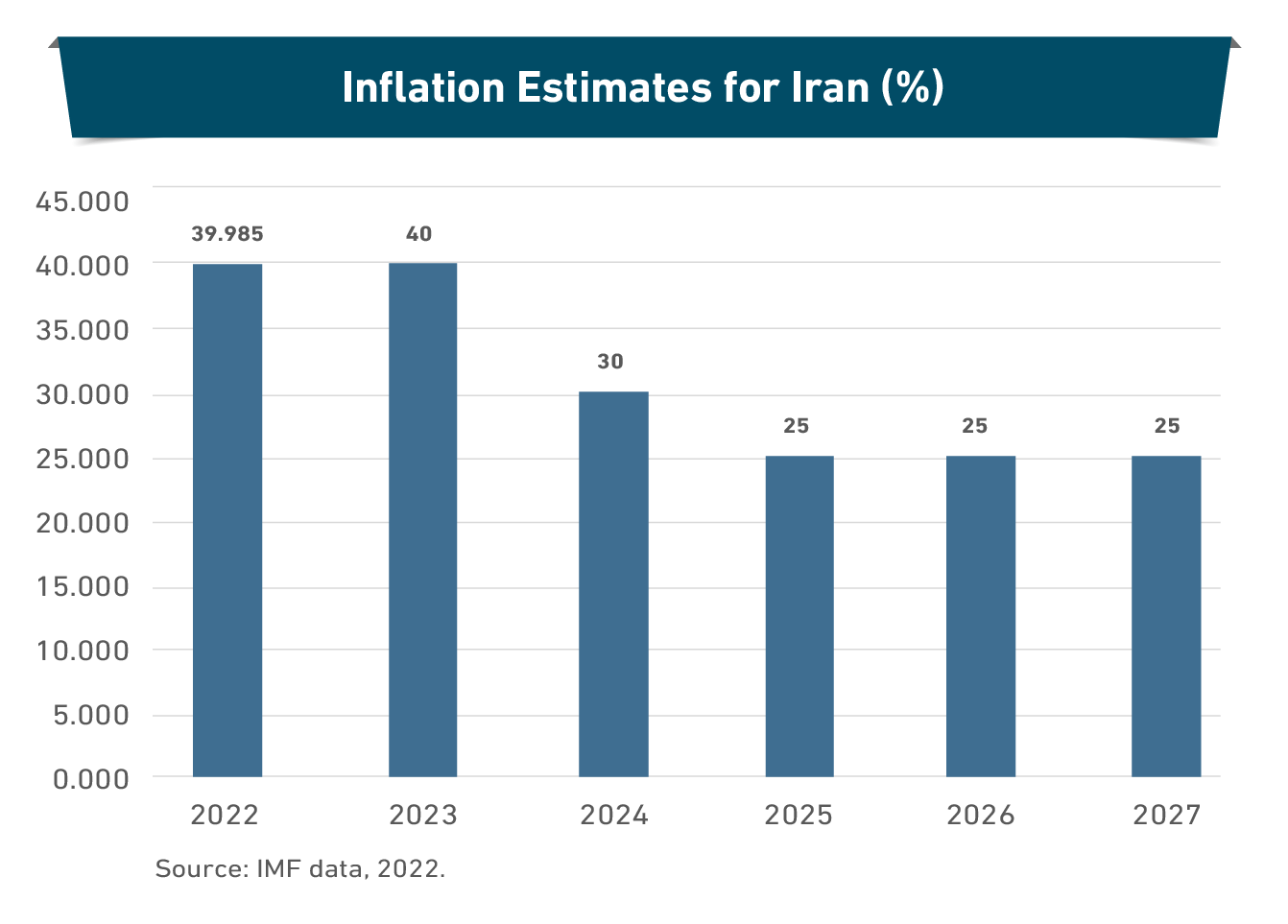

1. Inflation soaring to record highs:

The IMF forecasts Iran's inflation to even out at 25% over the next five years, driven by the weakening rial, the ongoing deficit and the sanctions. This means the Iranians will continue to suffer from rising prices and deteriorating living conditions. Moreover, the World Bank expects that inflation in Iran to rise to 51.2% in the fiscal year 2022/2023 and to 42.6% in the fiscal year 2023/2024.

2. Failure to counter economic challenges:

The Iranian regime probably cannot handle the economic challenges and western sanctions in a way that would also accommodate citizens. That is because of the limited accessible foreign currency reserves and the government's worsening budget deficit. The World Bank forecasts the deficit to go up to 4.7% of the country's GDP in 2023, up from 4.5% in 2022. In the medium term, Tehran will fail to revive the economy before a nuclear deal is reached with the world powers.

Recently, hopes for the revival of talks over the nuclear deal evaporated after the protests broke out, especially after the United States and western allies declared their support for Iranian protesters. Consequently, the sanctions will continue to negatively impact Iran's economy and weaken its ability to attract investments and enhance its productive base.

The conclusion is that the recent protests in Iran are an expression of a great deal of widespread disappointment fuelled by the current social and economic policies. At the same time, they will further weaken the Iranian economy, which is already suffering from crises. The protests are, therefore, likely to continue as long as Iran does not change its existing policies.