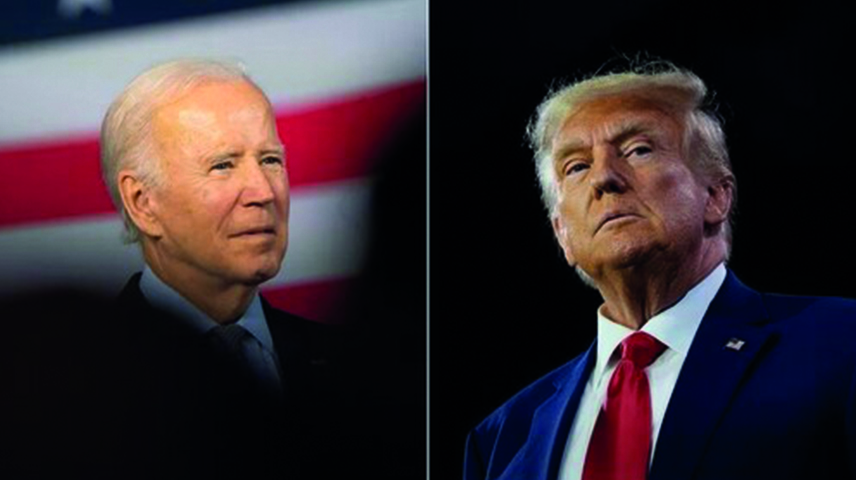

The world is eagerly waiting for the results of the US presidential election, which is highly regarded as the most important political event of the year. All eyes are focused on how this election may influence the global economy in various ways. With the two most probable election outcomes in mind, this article attempts to explain the ramifications for the Middle East region.

Biden’s Re-election Probability

President Biden's popularity is plummeting due to his ambiguous stance on Israel's aggression against Gaza and Rafah, which is costing him many Arab and Hispanic votes. Despite the fact that these votes realize that his rival, Trump, would not have a different strategic position and may even be more biased towards Israel in that war (as he himself revealed), the possibility of a punitive vote haunts the Democrats. There is also relative confidence in Trump's ability to resolve the war, even with conditions unfair to the Palestinians.

Biden has also faced criticism for the spike in illegal immigration, which has resulted in a crisis at the southern border. A Moody's assessment reveals that there have been 8 million encounters at the US-Mexico border since 2021, up from 2.3 million during Trump's administration.

Republican Candidate Chances

The Republican candidate, Donald Trump, is seeking re-election in the upcoming elections with the aim of continuing the policies he initiated eight years ago. These policies were quite radical, as they profoundly impacted the very foundation of the American way of life and the global hegemony of the United States.

During his previous presidential term, Trump ignited a trade war with China, steering his country away from globalization, freedom of trade, and vital environmental commitments. This included the withdrawal from the Paris Climate Agreement and its pledges, which have a pivotal impact on reducing global warming.

Trump has additionally sparked significant concerns in several areas, including freedom of expression, civil rights, and international affairs. If the American people were to re-elect Trump, despite his previous loss to President Joe Biden, it would be laden with profound implications and signals. One such signal would be a shift in the overall preferences of American voters. Trump’s preference for self-centered, anti-globalization policies is not devoid of political populism and severe economic neoliberalism.

Highlights from Biden's Economic Program

As for President Biden, he promises the American people more taxes and sets an economic program based on leveraging social protection and stricter border controls.

Economic growth

Growth rates during Biden’s next term are expected to be around 2.1%, which is consistent with the typical rates in the decade preceding the pandemic.

Immigration and employment

In early June, Biden signed an executive order that prohibits migrants who enter the country illegally from seeking asylum when the border is overcrowded. This move has drawn criticism from former President Trump, who promised to reverse the program, despite its alignment with his own past initiatives.

Additionally, Biden's proposed budget includes a plan to boost the number of refugees admitted to the United States. If approved, the number could reach up to 125,000, more than double the amount admitted in 2023. Furthermore, Biden has unveiled a new policy aimed at protecting unauthorized spouses of US citizens from deportation.

National taxes and tariffs

Biden wants to hike the corporate tax rate from 21% to 28%, which might not gain any support from Congress when re-elected. Biden's taxation ideas are gaining acceptance among the business community, as polls reveal. His plan aims to reduce public deficit and inflation by extending lower “personal” income tax rates to persons earning less than $400,000 per year. Lower-income households are also more inclined to spend their tax refunds rather than save them, which helps the economy grow more effectively.

Biden has chosen to retain the majority of Trump's original tariffs, while also imposing targeted tariff hikes, such as a 100% duty on Chinese electric vehicles and solar panels. According to a report by Moody's[1], it is likely that he will continue to utilize these customized tariffs to assist US firms in their competition against government-subsidized Chinese competitors. Despite these tariff adjustments, are expected to have little impact on the economy as a whole.

Social protection initiatives

Biden is proposing new social initiatives, including making child care cheaper, providing free college tuition, canceling more student loan debt, expanding portions of the Affordable Care Act, and lowering prescription prices. Such plans stand little chance of passing through a divided Congress.

Highlights from Trump’s Economic Program

Trump has signaled that he will intensify his trade war, which he sparked during his last term. Back then, he levied taxes on ten percent of American imports, which were only limited to solar panels, steel, washing machines, and several items coming from China. According to research by the Tax Foundation[2], the $80 billion gained in tariffs would result in a 0.21% reduction in the country's production and 166,000 fewer jobs over the long run.

Economic growth

Trump's proposal is projected to cause an economic slowdown by mid-2025, with the economy expected to grow an average of 1.3% per year throughout his four-year tenure, compared to the 2.1% growth rate under Biden. This is (in part) a result of several nations' propensity to treat American goods and services equitably, restricting US trade and perhaps money flows in the process through non-tariff barriers and customs procedures.

Immigration and employment

Under Trump's proposed measures, net immigration to the US would decrease from over 3.3 million last year to a few hundred thousand annually. This is in stark contrast to Biden's plan, which aims to maintain the historical average of 1 million per year.

Immigrants, both legal and undocumented, have played a crucial role in expanding the labor force expansion, especially during the pandemic-induced manpower shortages in recent years. As a result, the wage growth, which had previously fueled inflation, has come to a standstill. Notably, undocumented immigrants accounted for almost one-third of all employment increases in the United States last year, equating to approximately 1 million jobs.

Trump's proposal to severely restrict immigration would reverse such gains, particularly in businesses that rely significantly on foreign-born labor, including as agriculture, construction, restaurants, hotels, and retail, this would add pressure on economic growth projections.

Nonetheless, Moody's predicts that Trump's tax cuts will create around 450,000 more jobs than Biden's proposal by 2028.

National taxes and tariffs

Trump has stated that he will impose a 10% tax on all US imports, aiming to safeguard American industrial workers and address the country's trade imbalance. Additionally, he is expected to collaborate with a Republican Congress to extend the Tax Cut and Jobs Act (TCJA) for both lower and higher-income people. The TCJE, set to expire in 2025, has been estimated by the Committee for a Responsible Federal Budget to cost $5.2 trillion through 2035.

He has also proposed lowering the corporate tax rate, which was previously reduced from 35% to 21%, to as low as 15%. Extending the Act would also allow businesses to deduct new investments from their taxes immediately, rather than over time. However, these proposed tax cuts would increase the government’s reliance on debt to finance the expanding budget deficit, potentially leading to more economic turbulences and instability.

These slashes will have two functions. Even though they promote economic growth in the medium term, the direct effect of cutting state revenue raises worries about a fresh spike in inflation rates, coupled with a fall in employment rates against the background of the US Federal Reserve's unavoidable continuation of monetary tightening. Monetary policy, however, will remain subject to Trump’s interventions.

Lower taxes would only partially be offset by higher tariffs, adding to the $34 trillion national debt and eventually pushing up long-term interest rates,

Impact on inflation and cost of capital

Trump's broad tariffs would raise annual inflation, which is currently at 3.3%, by about three-quarters of a percentage point next year and half a point in 2026, according to Moody's. The additional charges would affect both individuals and hundreds of US firms who rely on imported parts and raw materials to produce their goods.

Conversely, higher tariffs are expected to boost the US currency by lowering imports and raising inflation and interest rates, thereby diminishing the appeal of the country's exports to foreign corporations. This scenario would adversely affect US firms and jobs, while also widening the trade deficit. Moreover, higher inflation rates will prompt tighter monetary policy (higher interest rates), further elevating the cost of capital.

Impact of the Elections on the Middle East

The Middle East has significant trading links with the United States. Therefore, if Trump is elected, the region's growth forecasts may be revised downward.

Republican candidate’s spillovers

Trade preferences in the region are expected to shift towards Asian goods, particularly Chinese ones, as an alternative to American products, which are likely to be saddled with restrictions.

The slow-down in growth expectations in the Middle East and other countries around the world, influenced by the United States and China, is expected to lead to a decrease in demand for oil and its derivatives, resulting in a decline in oil prices. The declining oil prices, in turn, potentially raises the prospects of an economic slowdown in oil-exporting countries, particularly the GCC.

However, the policies introduced by Trump to promote portfolio investments may partially offset this decline, especially if major Arab firms such as Aramco and Damac succeed in attracting American and European capital, thereby increasing their market capitalization and improving their opportunities for expansion and development while diversifying away from the most affected petroleum products.

Resuming monetary tightening in the United States beyond next year poses a significant threat to the most indebted countries, including Egypt and Tunisia, as it may lead to renewed financial crises in meeting their foreign obligations. This risk is amplified by the relatively stronger dollar and the US's partial withdrawal from the global economic scene, stemming from self-centered policies during the Trump administration.

If Biden is re-elected, the prospect of a more contained inflation rates nearing the target will likely drive interest rates down, alleviating the burden on foreign debt repayments. This could position the American economy as an essential engine for global growth, as seen over the last couple of years. During this period, the American and Indian economies exhibited extraordinary growth, while the Chinese economy was faltering. However, if Trump returns to power, this economic engine may become less efficient.

The strategy of economic isolation threatens to reduce America's economic standing, potentially allowing other nations and blocs to step in and fill the gap, particularly in the medium and long term. According to this scenario, dollar hegemony would be jeopardized because the trade war with China will be costly, resulting in de-dollarization, especially as other players mobilize to support China and Russia against the United States and its Western allies.

Democratic candidate spillovers

If Biden is re-elected, it is expected that there will be a lower impact on international trade and capital flow, maintaining his last term’s pattern of economic growth and oil prices in the Middle East. However, it is important to note that this scenario is considered the least likely according to current opinion surveys. So, in the event that Biden does continue to serve as president, other factors such as regional changes, climate change trajectories, and the ongoing conflicts in Ukraine and Gaza are likely to exert a more significant influence on the regional and global economy.

The scope of the Middle East war is likely to expand, particularly with the recent escalation between Israel and Hezbollah. This escalation increases the chances of Iran becoming a direct party in the war, increasing the chances of oil prices rising to levels approaching $150 (according to previous World Bank forecasts at the eve of the Gaza war).

It is also projected that the conflict between Europe and Russia would escalate to a dangerous level, with the prospect of military and possibly nuclear escalation between the two parties.

In fact, both elections outcomes raise concerns about the possibility of a deterioration in the American role in regional conflicts. Softer US grip on global dynamics, leads to a loss of American hegemony in favor of alternative organizations, which may include regional or trans-regional blocs.

India, a vital eastern ally to the US, must take a firm stance on these impending developments. India's biases may shift unexpectedly toward the Far and Near East and Eastern Europe, particularly under its less popular leadership, during the next US presidential term...but all of this is dependent on the actions of the American President, as well as the degree of fragmentation in Congress over the next four years.