China’s economic presence in the Middle East has remarkably expanded in the recent period, amid sudden political crises plaguing several countries and ensuing looming economic difficulties. Several indicators demonstrate China’s growing role, most notably providing development financing to the crisis-ridden countries, promoting the participation of Chinese companies in various economic sectors, and assisting some countries, like Iran, in the marketing of their oil. Despite China’s eagerness to portray itself as a developmental rather than a geopolitical actor, its desire to preserve its economic interests in the future will gradually push it to abandon its conservative political role.

Sudden Crises

At present, several states in the Middle East are facing exceptional circumstances amid international and regional shifts that create considerable economic difficulties. Turkey is one of the countries hit by a recent economic crisis, exacerbated by the decline of the lira, combined with souring relations with the US, and the intervention of the Turkish authorities to pressure the central bank to stop interest rates from increasing. This has driven the currency to shed more than one-third of its value since the beginning of the year, reaching now 6.3 lira for the dollar.

As for Iran, the US has imposed economic sanctions on Tehran since August, which are to be ramped up in November, extending to all economic activities, especially oil, in a way that will result in a large economic downturn due to the decline in oil exports in quantities no less than half a million barrels, along with the suspension of foreign, European and US companies from doing business and investing in the Iranian market.

In addition, the political prospects for many states in the region -albeit they have relatively improved in the past two years- remain unstable due to social and political tensions and burdens of the refugee crisis, which in turn put persistent economic pressures on such states.For example, the Middle East region needs at least $100 billion a year until 2030 to maintain economic growth rates and improve health, education, and other services.

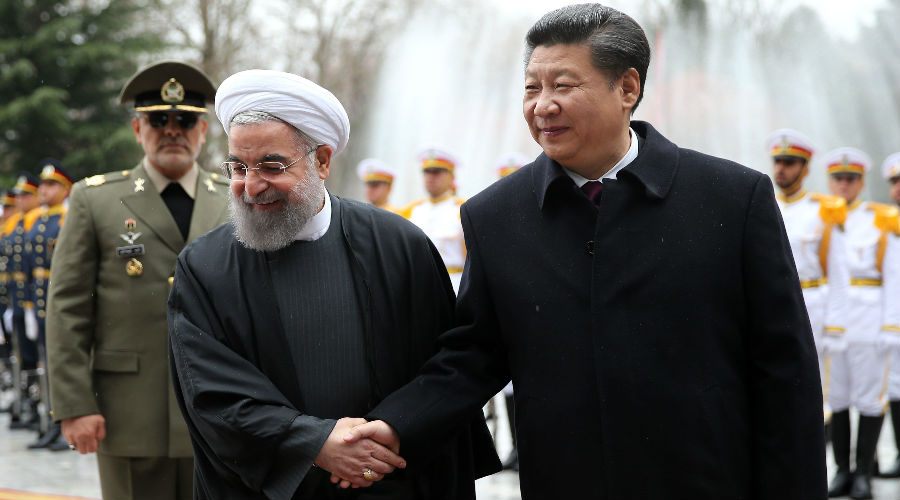

In contrast, China in recent years has become more open in its political and economic relations with many regions of the world, including the Middle East. China’s foreign policy shows great interest in the region, whose oil supply plays a key role in Beijing energy security, since it gets about half of its annual oil imports from different countries in the Middle East. Moreover, the region is a key pillar of China’s new Silk Road Initiative, launched in 2013, to connect the Chinese west to Central Asia and Europe through several Middle Eastern countries, including Iran. For that end, China has embarked on large-scale infrastructure projects, including roads and land and sea transport to achieve the objectives of this initiative. In addition, China is particularly interested in expanding security and military cooperation with all countries in the region, not only to secure its economic interests but also to stem the tide of terrorist organizations in the region and Asia.

Multiple Mechanisms

China has recently played an exceptional role in supporting some Middle Eastern economies, as the following indicators show:

1- Alternative financing: China’s financial institutions have recently expanded lending to several Middle Eastern governments and companies to implement development projects, becoming one of the additional sources of funding. This comes amid worsening political and economic crises in several countries, such as Turkey, which has recently obtained a loan package from Chinese financial institutions worth $3.6 billion for use in energy and transport sectors, according to the remarks of the Turkish Finance Minister Berat Albayrak in last July.

Turkey plans to issue yuan-denominated bonds for the first time, in a move to diversify funding sources other than dollar bonds, and bonds denominated in euros. Years ago, Turkey and China- similar to deals signed with other countries in the region- concluded a 10-billion-yuan currency exchange agreement in 2012, and in 2015 the two sides extended the agreement for three years, reaching 12 billion yuan (1.88 billion dollars).

More broadly, during the eighth session of the Sino-Arab Cooperation Forum (CASCF), Chinese president Xi Jinping pledged in July to provide a package of $20 billion in loans to the Arab region, along with financial aid of some $106 million for Jordan, Syria, Lebanon, Yemen and the Palestinian Territories. A consortium of banks from China and Arab countries will be set up with funding of $3 billion.

2- Exceptional buyer: From the outset, China has opposed the US withdrawal from the nuclear deal, reached by Iran and the P5 + 1 Group on July 14, 2015. The Chinese Foreign Ministry dismissed the new US sanctions on Iran as one-sided, emphasizing, on various occasions, its continued trade cooperation with Iran, in a way that does not violate, in its view, any UN Security Council resolutions.

Given the importance of oil in trade relations between the two countries, Chinese oil companies hinted at the continued import of Iranian oil, although the US urged the world countries to stop all imports of Iranian oil. Sinopec, China’s largest refining company, underlined in a statement issued last August, that its refineries would lose if it stopped importing Iranian crude, while the Zhuhai Zhenrong and PetroChina oil trading companies set in motion a clause in the long-term supply agreements with the National Iranian Oil Company, allowing them to use carriers operated by the Iranian company and refine the Iranian heavy oil.

Meanwhile, numerous estimates suggest the possibility that the Chinese company CNPC would purchase the share of Total, the French oil company, in the development of the 50.1% South Pars gas field to increase its overall share to 80.1%, after Total confirmed its exit from the Iranian market for fear of sanctions.

3- A growing presence: Chinese companies’ presence in the Middle East markets is expanding gradually, covering all economic sectors, although their work has so far been largely concentrated in the natural resources sector, especially oil, as well as construction, contracting and manufacturing industries. Over the past months, Chinese oil companies have signed contracts for oil exploration and production with several countries in the region. For example, the Iraqi Ministry of Oil signed a contract with the Chinese ZhenHua oil company to develop the southern part of Eastern Baghdad oil field, along with other Chinese companies in Iraq, the most important of which is CNPC.

Furthermore, Chinese companies are eyeing other sectors, such as the China’s State Development & Investment Corporation (SDIC), which has acquired the 28% share of the Canada’s Nutrien worth $502 million in the Jordan’s Arab Potash Company. Chinese companies have also shown interest in stepping up their investments in the promising automotive sector in Morocco, including the China’s Citic Dicastal, which plans to invest $410 million to build two aluminum car wheel factories in northern Morocco, while the Chinese automotive manufacturer BYD, has signed, last December, an agreement with Morocco to set up an electric car factory near the city of Tangier.

Potential Shifts

China is clearly playing an increasing role in the economic activities in the Middle East, in various fields, including financing development projects, similar to the role of international institutions such as the World Bank, a matter welcomed by the Middle East countries seeking alternatives- albeit tactical ones -to the great powers like the US and EU countries.

Despite China’s repeated assertions, to promote itself as a development actor, the scope of its economic interests in the region will gradually push it to step in to influence the political situation in several countries, which will in turn reinforce its geopolitical weight. Thus, it will be eventually locked in competition over influence with major powers in the region.